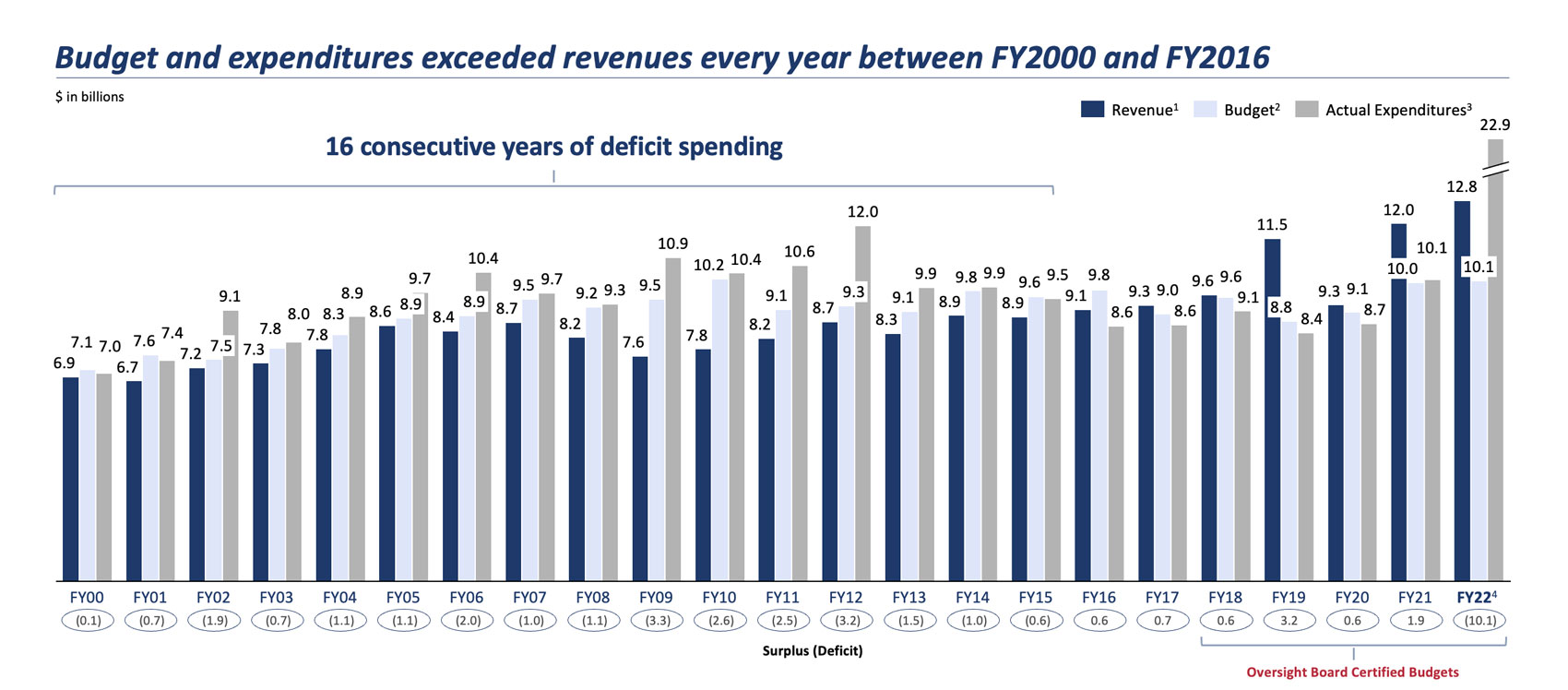

For the first 16 years of this century, the Government of Puerto Rico spent more money than it took in from revenues (taxes, fees, and support from the Federal Government). This is what led to Puerto Rico’s bankruptcy.

For the last eight years, the budgets certified by the Financial Oversight and Management Board for Puerto Rico ensured spending remained within Puerto Rico’s means. The $33.3 billion budget the members of the Oversight Board certified for fiscal year 2025, that started on July 1, 2024, continues this trend.

- General Fund revenue excludes financing sources.

- Budget values are from the original certified budget. FY2017 budget decrease primarily due to elimination of debt service.

- FY2016 actual expenditures did not include the full debt service payment.

- FY2022 actuals used cash accumulated from prior year surpluses to pay for settlements resulting from the Plan of Adjustment.

Source: Audited amount from the Basic Financial Statements, Exhibit: “Statement of Revenue and Expenditures-Budget and Actual Budget Basis-General Fund”.

Spending includes important investments in health, education, and infrastructure. The budget also includes new provisions to control government spending outside the budget process throughout the fiscal year, because a budget must not only be balanced at the beginning of the year; it must remain balanced at the end of the fiscal year. Otherwise, the Government will end up with a budget deficit, as happened for so many years before PROMESA was enacted.

The mistakes of the past cannot be repeated, and this is why the Government must stay within its budget and avoid spending what it does not have. This requires a process to establish spending priorities and discipline. However, before the budget for this fiscal year was even certified, the Legislative Assembly had already passed spending bills that were not included in the agreed-upon budget draft, with no regard for their estimated costs. Many bills were even passed without any prior assessment of their potential fiscal impact.

The bills would cost Puerto Rico taxpayers almost $900 million in this fiscal year alone, and at least $6 billion over the next 20 years. If these bills had become law and were implemented, it might have pushed the budget right back into deficit.

That cannot be. The Government must do better.

Think about your household: When you plan to renovate your kitchen, you first ask a contractor what it might cost. You choose your appliances and make sure you have the money. When the work begins, you make sure you stay within the budget you decided you can afford. What the Legislature did was as if you added a bathroom to the kitchen renovation without making sure money is there to pay for it.

This is why the certified budget includes new provisions that now require the Legislature and Executive to certify that the money they spend is actually available. The new budget stipulation also mandates that all spending bills must comply with the Fiscal Plan for Puerto Rico.

The Government, like households, must follow its budget. If a household has a monthly budget of $3,000 to cover its expenses, such as housing, food, transportation, and utilities, it cannot spend an extra $500. Regular overspending leads to debt and more debt, and in some cases can lead to bankruptcy.

Discipline is needed to ensure budgets are balanced and that they remain balanced throughout the fiscal year. Puerto Rico must break the pattern of spending without budgeting, passing legislation and figuring out how to pay for it later and spending what it does not have to fund commitments in future years, and the Oversight Board will continue to work with the Government to ensure fiscal discipline becomes permanent.

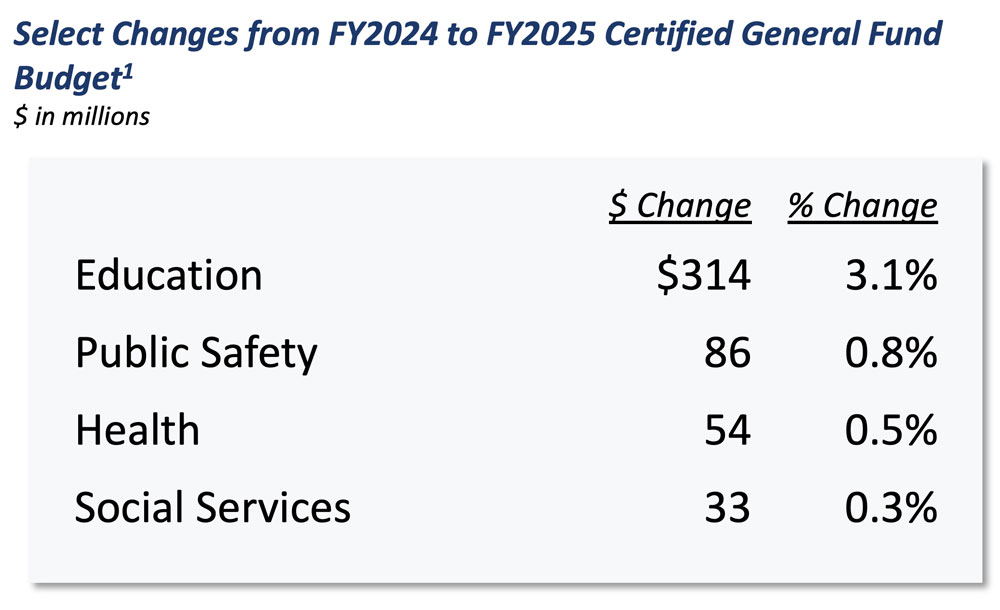

Fiscal discipline does not mean austerity, but, rather, responsible management of financial resources. It allows for investments in areas like infrastructure, education and health. In the current fiscal year 2025, we increased the budget to include important and needed investments in healthcare, public safety, social services, and higher education, among others. The budget includes investments in higher education and Puerto Rico’s civil service to ensure the Government has a strong workforce created based on merit, competence, and achievement, and it adds funding to municipalities for the services they provide to residents.

Budgets establish priorities to ensure dollars are available to fund them. The fiscal discipline means staying within your means to ensure established priorities can be funded today, tomorrow and in future years.

How to instill better discipline? The Oversight Board developed a comprehensive process to evaluate budget changes throughout the year to ensure sufficient funding sources are available to support operating needs. Furthermore, the Oversight Board is publishing quarterly financial reports that provide a detailed analysis of Puerto Rico’s fiscal situation and the real financial risks of multi-year spending projections, which are based on current laws and services.

Nevertheless, the Government must still build permanent reliable processes and systems to provide the tools for financial discipline and fiscal responsibility. The Fiscal Plan defines eight key areas on which the Government should focus to establish permanent, robust financial management and oversight practices:

- Improved economic and revenue forecasting. The Government should establish a process to produce a consensus multi-year revenue forecast.

- Budget management best practices. The Government must establish a comprehensive budget framework that includes procurement, budgeting, revenue administration, and performance management.

- Comprehensive capital delivery program. Without a long-term plan, Puerto Rico does not know how to prioritize investments and maximize funding sources to ensure sufficient funds are available for its infrastructure needs.

- Improved management of education resources. The Government must support high-quality education for Puerto Rico’s children and higher-education students that is equitable, fiscally sustainable, and transparent.

- Improved government service delivery & labor relations. The Government must undertake significant reforms to improve public services in Puerto Rico by building a more efficient civil service and addressing challenges regarding labor relations.

- Outcome-based, data-driven, and controlled healthcare spending. The Government must take an active role to support the improvement of public health outcomes and ensure the financial sustainability of Puerto Rico’s healthcare system.

- Improved, transparent financial reporting. The Government must address fiscal management deficiencies and track and report key information about Puerto Rico’s financial condition, such as the performance of revenues and expenditures.

- Optimized municipal fiscal management. The Oversight Board will continue to work with the Government and the municipalities to improve performance and accountability via a restructured grant and transfer system that incentivizes municipalities to perform well in key municipal service areas, including permitting.

Puerto Rico’s budget process must be reformed. PROMESA mandates fiscal responsibility, and responsible budgeting means every dollar spent must be accounted for – in Government, just like in any household or business.

The approval of the budget is more than just a financial decision; it’s a statement of Government priorities and a commitment to invest in the future of the people of Puerto Rico, without spending that would tip Puerto Rico back into deficit.