Puerto Rico’s Debt

Restructuring Process

When PROMESA was enacted, Puerto Rico faced an unsustainable burden of more than $70 billion in debt and more than $55 billion in unfunded pension liabilities with no legal path to restructure its liabilities and stabilize its finances. Puerto Rico had lost access to capital markets.

PROMESA provides mechanisms for restructuring this debt:

- PROMESA’s Title III follows roughly the U.S. bankruptcy law. Puerto Rico’s creditors are separated into groups based on the different legal rights of their claims, such as the kind of bonds they own or other claims, such as pensions. The Oversight Board negotiates plans of adjustments to lower Puerto Rico’s debt to sustainable levels, subject to a confirmation process by the federal court. Some creditor groups might reject the plan, but once the court confirms the plan it becomes binding on all groups, even those who rejected it.

- PROMESA’s Title VI requires that all groups of creditors accept the plan before the court can confirm it, and is primarily aimed at financial debt, not pensions or other types of claims.

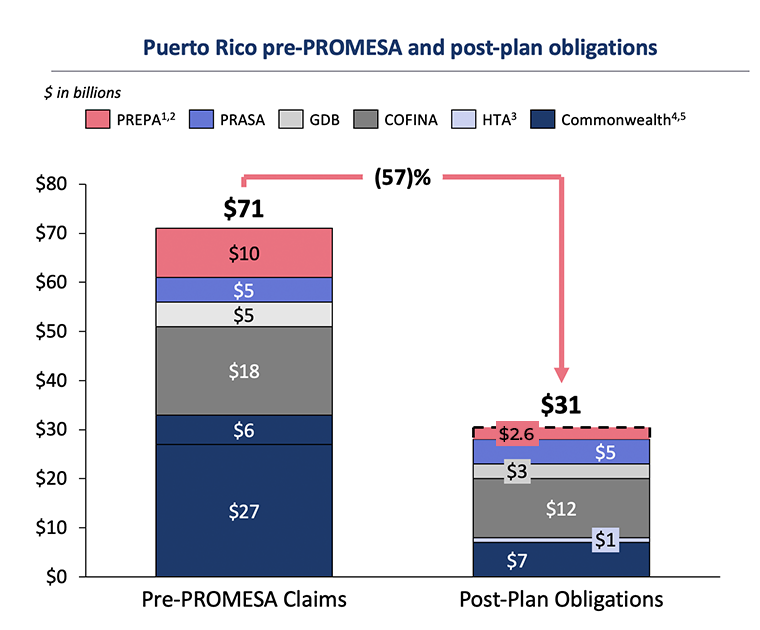

The Oversight Board, together with the Government of Puerto Rico, so far restructured about 80% of Puerto Rico’s outstanding debt, lowering total liabilities from more than $70 billion to a sustainable $37 billion, which will save Puerto Rico more than $50 billion in debt service payments. The debt restructuring process continues.

The Oversight Board reduced Puerto Rico’s debt by more than $40 billion

The Oversight Board saved Puerto Rico over $50 billion in principal and interest payments

Footnotes

- Pre-PROMESA Claims include publicly issued debt, including General Obligation (GO), Public Building Authority (PBA), Employee Retirement System (ERS), Puerto Rico Infrastructure Financing Authority (PRIFA), Convention Center District Authority (CCDA), Metropolitan Bus Authority (MBA), Puerto Rico Sales Tax Financing Corporation (COFINA), Highway and Transportation Authority (HTA), Puerto Rico Electric Power Authority (PREPA), Puerto Rico Aqueducts and Sewers Authority (PRASA), Puerto Rico Industrial Development Company (PRIDCO), University of Puerto Rico (UPR), Puerto Rico Government Development Bank (GDB), Public Finance Corporation (PFC), Commonwealth General Unsecured Creditor (GUC), Eminent Domain, ACR, Dairy Producers, 330 Health Centers, and other claims as of the Plan Effective Date (March 2022), as well as PREPA and HTA GUC and other claims.

- Post-restructuring obligations represent the amount of the comparable debt issuances after various pending and completed restructurings, SUT and Rum Tax contingent value instrument (CVI) actual payments through FY24. SUT and rum tax CVIs have a maximum cumulative payment of $10 billion

- Post-restructuring obligations does not include HTA debt, because it was extinguished from the proceeds of the HTA Toll Roads Concession Private Public Partnership (P3) transaction in December 2023. However, post-restructuring debt service does include $1.2 billion of HTA debt service paid through December 2023. Remaining HTA debt service is not included as it was extinguished as a part of the P3 transaction.

- PREPA’s Pre-PROMESA Claims include ~$9 billion of bonded debt and ~$1 billion estimated GUC claim as listed in PREPA Title III Amended Disclosure Statement approved on November 17, 2023

- PREPA’s Post-restructuring obligations of ~$2.6 billion represents the recovery to creditors in the Corrected 4th amended Plan of Adjustment, dated December 29, 2023. PREPA restructuring subject to Plan of Adjustment confirmation

- Title III Fees submitted to the fee examiner through October 31, 2024

- Pre-PROMESA Claims include ~$9 billion of bonded debt and ~$1 million est. GUCs pool per PREPA Title III Amended Disclosure Statement filed on March 3, 2023

- Post-Plan Obligations of ~$2.6 billion represents the estimated value PREPA can provide to support creditors pursuant to the Debt Sustainability Analysis included in the PREPA certified 2023 Fiscal Plan, dated June 23, 2023

- Post-Plan Obligations of ~$1 billion settles ~$6 billion of CW related claims under the HTA Plan of Adjustment and supported by HTA toll revenues

- Pre-PROMESA Claims include GO/PBA of ~$19 billion, est. GUCs of ~$3 billion, and ERS of ~$3 billion, as well as ~$2 billion PRIFA and ~$450 million CCDA and MBA (other-clawback entities)

- Post-Plan Obligations Includes General Obligation claims,; but excludes CVI Claims

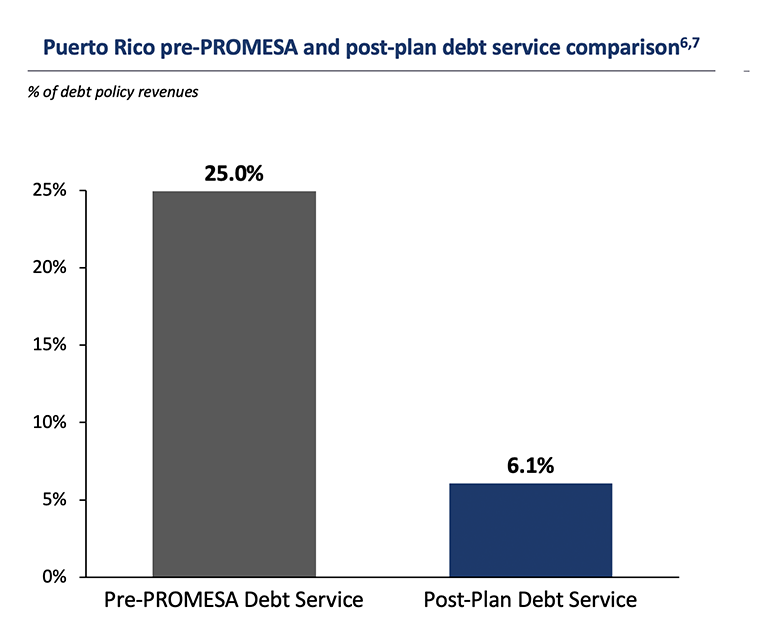

- Pre-PROMESA Debt Service from 2022 Certified Fiscal Plan and Moody’s Investor Service “State Government – U.S. Medians,” 2020. (Moody’s 2015 number was adjusted to exclude HTA debt service).

- Post-Plan Debt Service represents FY23 Commonwealth debt service, including COFINA, as a percent of own-source revenues.

For copies of the documents filed in the Title III cases, please visit https://cases.ra.kroll.com/puertorico. Copies of the documents are also available by calling +1 (844) 822-9231

Completed Debt Restructurings

- Reduces the Commonwealth’s total debt service payments (including COFINA senior bonds) by more than 60%, from $90.4 billion to $34.1 billion, saving Puerto Rico more than $50 billion in debt service payments.

- Reduces the burden of debt payments from 25 cents of every dollar in taxes and fees collected by the government before PROMESA to less than 7 cents

- Protects and preserves pensions through the establishment of a pension reserve trust that is forecasted to receive $10 billion in contributions over 10 years

- Enrolls teachers and judges in Social Security for first time, only remaining civil servants without access

- Restores more than $1.2 bn of 50,000 employee contributions to Sistema 2000 notional pensions

- Provides AFSCME/SPU union members with signing bonuses and increased healthcare

- Settles hundreds of litigations otherwise costing tens of millions of dollars in legal fees

- Provides payment in full for small government vendors with small claims and certain public employee claims

- Reduced $18 billion of COFINA debt by $6 billion, to $12 billion.

- Reduced debt service payments by 32%, saving the people of Puerto Rico approximately $17.5 billion that will now be available to support the financial needs of the central government.

Documents:

- Reduced about $5 billion of debt by more than $2 billion, to about $3 billion, reducing the face value of claims by 45%.

- Debt payments are secured by GDB cash flow from certain legacy assets without recourse to the Puerto Rico Government.

- Effect of the restructuring cushions municipalities by offsetting the loans they owed to the GDB by the full amount of their deposits at GDB.

Documents:

- Lowers PRASA’s debt service payments on the U.S. Government program loans by about $380 million over the next 10 years.

- Eliminates approximately $1 billion in guaranty claims against the Puerto Rico Government.

- Provides PRASA with access to $400 million in new federal funding through various clean water programs over the next five years to support PRASA’s ongoing effort to improve water quality and safety for the people of Puerto Rico.

Documents:

On October 12, 2022, Judge Laura Taylor Swain of the U.S. District Court for the District of Puerto Rico confirmed the Plan of Adjustment for the Puerto Rico Highway and Transportation Authority (HTA).

The Plan became effective on December 6, 2022. It reduced HTA’s $6.4 billion in claims by more than 80% and saves Puerto Rico more than $3 billion in debt service payments.

The Plan of Adjustment creates a solid financial foundation to ensure Puerto Rico’s roads and public transportation system are maintained and improved. HTA will now be able to implement the transportation sector reforms set forth in the certified HTA and Commonwealth Fiscal Plans.

Documents:

Debt restructurings in progress

PREPA

On December 16, 2022, the Oversight Board filed its proposed Plan of Adjustment to restructure more than $10 billion of debt and other claims against the Puerto Rico Electric Power Authority (PREPA) with the U.S. District Court for the District of Puerto Rico. The proposed Plan, as amended, would reduce PREPA’s unsustainable debt by around 80%, to approximately $2.6 billion, excluding pension liabilities. The U.S. District Court has since directed the parties to PREPA’s debt restructuring under Title III of PROMESA to return to mediation. The Oversight Board is negotiating in good faith and in the interest of the people of Puerto Rico. PREPA’s bankruptcy held back the transformation of Puerto Rico’s energy system, and the goal of the debt restructuring is to provide the financial stability necessary to invest in a modern, resilient, and reliable energy system for Puerto Rico.

The Context

Debt

PROMESA opened a path to end this crisis. The law gives Puerto Rico an opportunity no U.S. state has: a formal process similar to municipal bankruptcy to restructure its debt to levels it can afford. The Oversight Board filed a Plan of Adjustment with the U.S. District Court for the District of Puerto Rico that reduces the debt by 80% and saves Puerto Rico more than $50 billion in debt service payments.

Puerto Rico’s debt was issued by more than a dozen public entities, ranging from the central government itself and the public employee retirement system to separate public corporations such as the Puerto Rico Electric Power Authority and the University of Puerto Rico.

Creditors

Comprehensive review of the debt

- The report investigated Puerto Rico’s debt going back to 2006. It investigated how much debt was issued and the use of the proceeds. It dug deep into debt issuance and selling practices; the range of debt instruments; how Puerto Rico’s debt practices compare to those of states and large municipal jurisdictions; and how the debt ultimately contributed to Puerto Rico’s structural budget deficit.

- The independent investigator reviewed approximately 260,800 documents consisting of approximately 2.7 million pages and interviewed 120 witnesses, including former and current senior government officers, underwriters, rating agencies, and outside professionals and advisors.

Based on the Report, the Oversight Board, along with the Unsecured Creditors Committee challenged the legitimacy of $6 billion of Commonwealth debt in the U.S. District Court for the District of Puerto Rico. Ultimately, the issues as to the “validity” of the debt was settled with the Plan of Adjustment.

Towards the future…

The Plan of Adjustment established a Debt Management Policy to prevent Puerto Rico from repeating past mistakes that led to the accumulation of its unsustainable debt.

- New debt may only be used to finance capital improvements, not operating deficits.

- Refinancing debt is only permitted if it saves Puerto Rico money and the principal outstanding is not increased. Refinancing without savings is only allowed in direct response to a natural disaster or other similar emergency.

- New debt may not have a maturity greater than thirty years, and refinancing debt may not extend the repayment terms of existing debt (with a few exceptions, such as for public housing).

- All new debt must begin to be repaid within 2-5 years of issuance.

For copies of the documents filed in the Title III cases, please visit https://cases.ra.kroll.com/puertorico. Copies of the documents are also available by calling +1 (844) 822-9231