PREPA Plan of Adjustment

Frequently Asked Questions

The Plan of Adjustment would reduce more than $10 billion of total asserted claims by various creditors against the Puerto Rico Electric Power Authority (PREPA) by almost 80%, to the equivalent of $2.6 billion, excluding pension liabilities.

The Plan would save Puerto Rico about $15 billion in principal and interest payments, reducing payments to creditors from about $20 billion to about $5 billion.

A Plan of Adjustment under Title III of PROMESA defines the terms of a debt restructuring to allow PREPA to reduce debt to become a solvent, stable, and sustainable utility.

PREPA had a potential debt deal in place in 2017 that would have paid bondholders a recovery of over 80% and paid several creditors in full. At that time, the Oversight Board was not involved in the negotiations between PREPA and its bondholders, and their preliminary agreement was not a Plan of Adjustment under Title III of PROMESA. A Plan of Adjustment can provide for a much more comprehensive restructuring of PREPA’s liabilities than a deal with bondholders.

The Oversight Board reviewed the 2017 agreement and concluded that the terms, including recoveries to certain bondholders, were not in Puerto Rico’s best interests.

PREPA has many different classes of creditors with different legal rights. The Plan of Adjustment defines the terms of repayment for each type of claimholder, bondholders, vendors, and retirees.

Under PROMESA, only the Oversight Board may file a Plan of Adjustment on behalf of PREPA. Any Plan of Adjustment must be confirmed by the U.S. District Court for the District of Puerto Rico, which has jurisdiction over PREPA’s Title III case. To be confirmed, the Plan of Adjustment must be accepted by at least one class of creditors being impaired by the Plan. Once the court confirms the Plan, it becomes binding on all groups, even those who rejected it.

- Bondholders, ranging from mutual funds and individual investors to large hedge funds and bond insurance companies

- Lenders who provided financing for fuel for PREPA’s power plants

- Unsecured creditors, including other vendors providing goods or services to PREPA, who were not paid before PREPA filed for a debt-restructuring case under Title III of PROMESA

- PREPA’s pension system, which is entitled to received certain contributions from PREPA as employer of system participants for the purpose of funding pension payments to PREPA’s more than 12,000 retirees

Creditors including bondholders, vendors, and others claim PREPA owes them over $10 billion. In addition, PREPA owes its retirement system around $4.4 billion in present and future obligations.

Bondholders alone claimed PREPA owed them about $8.4 billion. The Oversight Board challenged their claim, and the U.S. District Court for the District of Puerto Rico subsequently ruled that bondholders have an allowed claim of $2.4 billion. The Plan of Adjustment proposes to pay bondholders about $1.57 billion (including fees related to the Plan).

The Plan of Adjustment also includes an agreement with the holders of approximately $700 million in fuel line loans to PREPA to reduce their claim by 16%, to about $590 million.

The claims of unsecured creditors, for example vendors PREPA did not pay before it filed bankruptcy under Title III of PROMESA, are estimated at about $800 million. Under a recent settlement with the Official Committee of Unsecured Creditors, unsecured creditors would receive an initial recovery of approximately 42% of this amount, or $335 million, plus other contingent recoveries. Their recovery percentage will increase or decrease depending on the amount of unsecured claims ultimately allowed when the claim objection process is finished.

PREPA does not have to repay all the debt it owes, but it must repay the amount its income allows it to repay while charging just and reasonable rates to its customers.

For decades, PREPA did not set electricity rates at a rate that would cover its operating expenses, including contributions to its retirement system. Instead, it kept rates per kilowatt hour (kWh) low (the largest share of a PREPA customer bill is directly tied to fuel costs, not to electricity rates per kWh) and neglected investments in more modern and cleaner power generation, neglected the maintenance of its grid – and kept borrowing to simply maintain operations.

The borrowings were mostly made in the form of bonds. Bonds are certificates that represent agreements with investors to lend PREPA money under specific contractual terms, including interest.

In addition, PREPA incurred other debt. It borrowed money to pay for fuel, it failed to put sufficient money aside to provide for the pensions it promised retired employees, and it owed money to vendors.

None of these debts are being paid in full under PREPA’s proposed Plan of Adjustment. PREPA’s obligations will be adjusted to levels the Oversight Board believes PREPA will be able to pay by charging a justifiable and reasonable Legacy Charge to its customers.

The Plan of Adjustment the Oversight Board proposed cuts PREPA’s debt by about 80% and provides a path to end bankruptcy by reducing PREPA’s debt in a way the Oversight Board believes the U.S. District Court for the District of Puerto Rico will confirm and PREPA will be able to satisfy.

The Oversight Board fought in court to eliminate invalid debt and the U.S. District Court ruled to substantially lower bondholders’ legal claim. It is not legally possible, however, to eliminate all PREPA’s debt entirely.

The Oversight Board challenged nearly the entire debt owed to bondholders, approximately $8.4 billion. Bondholders contend they have a lien, similar to a mortgage, on all PREPA’s present and future revenues. The Oversight Board argued that bondholders only have a lien against the money PREPA deposited into certain accounts set up under the bond agreements specifically for debt payments, known as the sinking fund.

The agreement requires PREPA to deposit money into these accounts only after PREPA pays its operating expenses and funds certain operating reserves.

On March 22, 2023, U.S. District Court Judge Laura Taylor Swain upheld the Oversight Board’s position that the bondholders’ collateral is limited to money in the sinking fund, currently just over $20 million.

However, Judge Swain also held that bondholders have a claim against PREPA other than their collateral held in the sinking fund, in the amount bondholders could reasonably expect to recover by exercising certain remedies under their bond documents. On June 27, 2023, Judge Swain ruled that PREPA owes bondholders about $2.4 billion, rather than $8.4 billion. The Plan of Adjustment proposes to pay bondholders a total of $1.57 billion (including fees related to the Plan).

The members of the Oversight Board are aware that residents and businesses of Puerto Rico will have to shoulder the payments of this significantly reduced debt through their electricity bills.

PREPA’s customers are not to blame for this bankruptcy. Nevertheless, PREPA’s debt cannot be eliminated completely. PREPA will have to repay creditors at least a part of what they are owed. That is the law.

PREPA can only pay the reduced debt from the revenue it collects from customers for the electricity they receive. Electric utilities like PREPA would never be able to borrow money for necessary investments and important upgrades if they did not charge customers enough to pay their expenses, including to repay their borrowings.

That is why PREPA must raise rates to repay some of its borrowings under its Plan of Adjustment. The Oversight Board cannot fully protect households and businesses from all debt payments. It is not legally possible.

PREPA, like any entity, is responsible for its own debt. The Oversight Board believes that a government bailout for PREPA is neither fiscally responsible nor feasible. Even if the government were to pay some or all of PREPA’s debt, the government would have to raise money from Puerto Rico’s residents through taxes or cut spending on important government services to finance such a bailout. (For more information, please read Treasury Single Account: How Much Money Does Puerto Rico Really Have?)

Under PROMESA, the Oversight Board is the sole representative of Puerto Rico and PREPA in the debt-restructuring process. The PREPA Plan of Adjustment is the result of extensive mediation and litigation, and a significant number of creditors agreed to the realistic terms of the drastically reduced debt and interest payments.

The proposed PREPA Plan of Adjustment is a viable and fair debt restructuring that reflects the recent order by the U.S. District Court for the District of Puerto Rico to reduce bondholder claims and the reality of PREPA’s financial future and investment needs.

Though certain bondholders continue to litigate the amount they claim to be owed even after Judge Swain’s decision, the Oversight Board believes the Plan it filed is confirmable by the court.

PREPA must generate sufficient revenue to cover all its operating costs, including debt and pension payments, to be on a sound financial footing going forward. PREPA must never go bankrupt again.

After the debt is issued on the effective date post confirmation, the new PREPA debt will be governed by the Plan of Adjustment and its supporting documents.

In all public bankruptcy proceedings, plans of adjustment are amended between the initial filing and the court’s confirmation to reflect current information and data, and to add agreements with parties who hadn’t initially agreed to the plan.

In December, the Oversight Board amended the Plan to reflect the agreement with the Official Committee of Unsecured Creditors, a group of mainly Puerto Rican creditors.

Previously, the Plan of Adjustment was amended to conform to the debt-sustainability analysis in the revised PREPA Fiscal Plan the Oversight Board certified in June 2023. That analysis is based on the most recent projections of PREPA’s operating costs and future demand for its services. The analysis showed PREPA can afford to repay materially less debt than the prior analysis indicated.

The amended Plan of Adjustment also reflects the order by the U.S. District Court for the District of Puerto Rico reducing the total bondholder claims from around $8.5 billion to an allowed claim of about $2.4 billion.

- Agreements with several creditor groups who support the Plan

- Restructuring Support Agreement (RSA) with BlackRock Financial Management Inc., Nuveen Asset Management LLC, Franklin Advisers, Whitebox Advisors LLC, and Taconic Capital Advisors LP

- RSA with National Public Finance Guarantee Corp.

- RSA with Fuel Line Lenders

- Settlement with the Unsecured Creditors Committee

- RSA with Vitol Inc.

- Terms for bondholders who did not join the RSA

- Terms for PREPA’s pension plan

- Contingent Value Instruments: provides creditors additional recovery only if (a) future demand for power from PREPA exceeds projections or (b) PREPA achieves certain cost savings

- If electricity demand exceeds projections in the PREPA Fiscal Plan and PREPA repays bonds sooner than 35 years

- Share of the savings in the cost of fuel generated by the private operator of PREPA’s power plants for the term of the private operator’s agreement.

For more information, please see the Plan of Adjustment and the Disclosure Statement, and the Oversight Board’s media releases:

PREPA can only pay the greatly reduced debt from a designated portion of the revenue it collects from customers. That is why the Plan proposes a Legacy Charge on electricity bills.

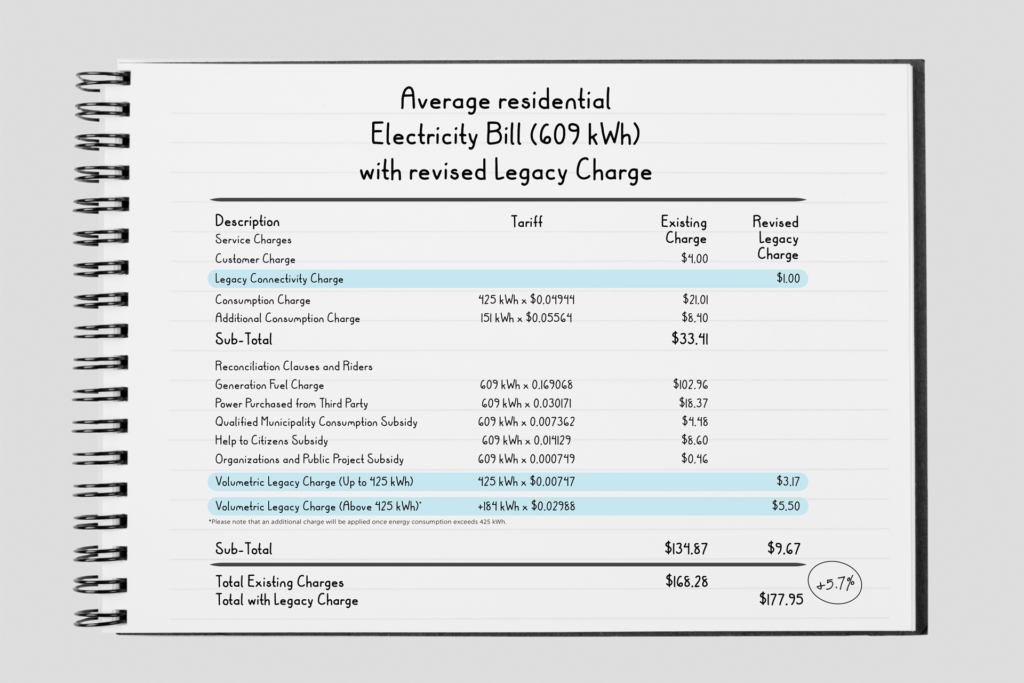

The estimated PREPA Legacy Charge for residential customers who do not currently benefit from subsidized electricity rates and will not be exempt from the Legacy Charge would be, on average, about $9.67 a month, a 5.7% increase in this customer group’s overall electricity bill.

The PREPA Legacy Charge would exclude qualifying low-income residential customers from the connection fee and the volumetric charge for up to 425 kilowatt hours (kWh) per month, the typical usage for median income households in Puerto Rico according to data provided by LUMA Energy and other sources. That means almost half of PREPA’s roughly 1.4 million residential customers will not pay any PREPA Legacy Charge if their consumption remains under 425 kWh per month.

For subsidized residential customers, the proposed PREPA Legacy Charge would be:

- No monthly connection fee

- Volumetric charge:

- No charge for up to 425 kWh per month of electricity provided by PREPA

- $0.015 per kWh for electricity above 425 kWh per month

For non-subsidized residential customers, the proposed PREPA Legacy Charge would be:

- A flat $1 per month connection fee

- A volumetric charge:

- $0.007 per kWh for up to 425 kWh per month of electricity provided by PREPA

- $0.03 per kWh for electricity above 425 kWh per month

Here is how the Legacy Charge compares to other charges on an average bill for a residential customer not benefiting from subsidized rates:

For commercial, industrial, and government customers, the proposed PREPA Legacy Charge would be:

- A connection fee of $1.25 per month for small business customers and smaller industrial companies, and up to $112.50 per month for large businesses proportional to their current rate.

- Between $0.015 and $0.03 per kWh per month for electricity provided by PREPA.

The proposed PREPA Legacy Charge remains subject to approval by the Puerto Rico Energy Bureau (PREB), the independent energy regulator.

For more information, please see the Oversight Board’s Fact Sheet on the Legacy Charge.

The Oversight Board projects that PREPA’s Legacy Charge, which is necessary to pay the substantially reduced debt, would remain in place for about 35 years.

The Plan of Adjustment will enable PREPA to end its long bankruptcy. No company can succeed in bankruptcy. Bankruptcy has real costs to PREPA customers. For instance, PREPA cannot raise money for modernization and transition to cleaner energy until it exits bankruptcy.

If PREPA had to pay its contractual debt under its original terms, it would have to pay $20 billion in interest and principal. Under the Plan of Adjustment, the total debt payments should be around $5 billion.

If PREPA had to pay its full contractual debt, the average electricity bill for households would increase by $50 a month. With the proposed Plan of Adjustment, the monthly increase would be $9.67.

If PREPA had to pay its full contractual debt, the average bill for a small business would increase by almost $132 a month, rather than the $35.53 proposed in the Plan of Adjustment.

The Plan of Adjustment is necessary for PREPA to remain a sustainable utility, continue critical investments, and complete the transformation of Puerto Rico’s energy system to provide reliable energy and support Puerto Rico’s economic growth and fiscal stability.

The U.S. District Court for the District of Puerto Rico ordered the confirmation hearings in to begin on March 4, 2024, and the hearings are scheduled to be held for 12 business days.

The Legacy Charge would be added to customers’ electricity bills after the Plan of Adjustment is confirmed by the Court and becomes effective, and the Puerto Rico Energy Bureau (PREB), the independent regulator, approves the Legacy Charge.

PREB might not approve the PREPA Legacy Charge the way it is described in the Plan of Adjustment. Under Puerto Rico law, however, electricity rates must be sufficient to comply with PREPA’s obligations to pay all its operating expenses, including the reduced debt.

The Legacy Charge was carefully structured by the Oversight Board and its advisors, including economists and energy experts. The Oversight Board hopes to gain PREB’s support for the Legacy Charge.

PREPA’s pension plan is insolvent. PREPA retirees receive the same treatment as Commonwealth retirees:

- PREPA’s defined benefit pension system will be frozen as of the Plan of Adjustment’s effective date, and cost of living adjustments will be eliminated.

- PREPA will pay its more than 12,000 retirees all pension benefits they will have earned as of the effective date.

Active participants in the system will be moved into defined contribution accounts similar to those established by Act 106 in 2017.

PREPA will fund payments to its more than 12,000 retired employees through the existing PREPA retirement system. Funding PREPA’s retirement system is an operating expense financed, like all operating expenses, by PREPA’s charges to customers.

PREPA has two remaining CBAs – one with UTIER, with approximately 139 active members remaining, and one with UEPI, with approximately 3 active members remaining.

Without consensual amendments, which are still under discussion with the unions, rejecting PREPA’s CBAs with UTIER and UEPI is necessary to allow for essential reform of pension benefits. The need for reform of PREPA’s pension system is unavoidable and urgent. PREPA’s pension system is insolvent.

The Oversight Board has gone to great lengths to ensure that retirees continue receiving their needed pensions. Most recently, the Oversight Board approved a loan from the Government of Puerto Rico to PREPA to continue to pay pensions because PREPA was unable to pay. Under the Plan of Adjustment, which would cut PREPA’s debt by 80%, PREPA retirees receive the same benefits as, teachers, police officers, and other public sector employees.

The Oversight Board negotiated with UTIER to reach an agreement on consensual modifications to the pension system and offered to continue discussions. The Oversight Board has also commenced discussion with UEPI.

PREPA’s customers are the only source of payments to the PREPA pension system. Unfortunately, UTIER has not agreed to a consensual resolution that would both protect PREPA’s customers and provide certainty for PREPA’s pensioners.

For more information, please see PREPA’s motion to reject the collective bargaining agreements and grant related relief.

Under Section 314(b) of PROMESA, in addition to the class acceptance requirement, the Plan must meet additional criteria:

- The debt payments must be feasible. That means PREPA’s revenue and expense projections that determine the payments to creditors must be realistic and attainable. PREPA must be able to afford the payments for the reduced debt.

- The Court must consider what all creditors would collectively receive outside bankruptcy if each were to litigate their claim in court by themselves.

- The Plan must be consistent with the PREPA Fiscal Plan.

- The Plan must be proposed in good faith.

The Plan of Adjustment identifies certain laws, rules, and regulations preempted by PROMESA.

Preemption does not mean those laws, rules, or regulations would be entirely invalidated or changed. Preemption means that to the extent certain laws, rules, and regulations of the Commonwealth of Puerto Rico, or portions thereof, are inconsistent with PREPA’s obligations under the debt restructuring, and thus inconsistent with PROMESA, the Plan shall prevail.

The preemption is limited to what is sufficient for implementation of the Plan of Adjustment.

The Plan does not nullify Act 17-2019, does not impede the transition of PREPA’s power generation to renewable energy sources as defined by Act 17, and does not seek to preempt the rate setting authority of the Puerto Rico Energy Bureau (PREB).

Certain provisions of Act 106-2017 are preempted to the extent they affect PREPA’s retirement system. Under the Plan, PREPA will provide funding to pay retirees all pension benefits earned through the Plan effective date, and active employees will be moved into defined contribution accounts. PREPA’s defined benefit pension system will be frozen and cost of living adjustments will be eliminated.

For more information, please see the Oversight Board’s statement on preemption.

Videos

Court Documents

- Adversary case 24 00062 PR PROMESA Complaint

- FOMB – Media Release – Act 10

- FOMB – JOINT MOTION to inform Joint Status Report of Conferring

- FOMB – PREPA POA – Informative Motion Regarding Confirmation Procedure

- FOMB – Statement – First Circuit – PREPA

- PREPA Opposition to Bondholders’ Urgent Motion to Reopen the Record

- PREPA POA – FOMB OBJECTION TO ADJOURN OR STAY CONFIRMATION PROCEEDINGS

- FOMB – PREPA POA – PREPA CBA

- FOMB – 3.b. 4.a. Commonwealth Title III – Corrected Fourth Amended Plan of Adjustment

- FOMB – PREPA – POA – Revised Best Interests Test Report

- FOMB – 3.a. 4.b. Commonwealth Title III – Modified Third Amended Plan of Adjustment

- FOMB – 3.a. 4.b. Commonwealth Title III – Supplemental Disclosure Statement

- FOMB – 3.a. 5.a. Commonwealth Title III – Third Amended Plan of Adjustment

- FOMB – PREPA POA – 3rd Amended POA – Supplemental Disclosure Statement

- FOMB – PREPA POA – 3rd Amended POA – Best Interest Test

- FOMB – PREPA – Third Amended PDA

- FOMB – PREPA – Third Amended PDA – Schedule A

- FOMB – PREPA – Third Amended PDA – Schedule B

- FOMB – PREPA – Third Amended PDA – Schedule C

- FOMB – PREPA – Third Amended PDA – Schedule D

- FOMB – PREPA – Third Amended PDA – Schedule E

- FOMB – Media Release – Amended PREPA POA

- PREPA – FLL PSA – First Amendment (Fully Executed)

- FOMB – Media Release – PREPA 2023 Fiscal Plan

- FOMB – PREPA – 2nd Amended Plan of Adjustment

- FOMB – PREPA – POA – 2nd Amended Disclosure Statement

- FOMB – Media Release – PREPA POA – Legacy Charge

- FOMB – PREPA – POA – Amended Disclosure Statement

- FOMB – PREPA – First Amended Title III Plan of Adjustment

- FOMB – PREPA – First Amended PDA – Schedule A

- FOMB – PREPA – First Amended PDA – Schedule B

- FOMB – PREPA – First Amended PDA – Schedule C

- FOMB – PREPA – First Amended PDA – Schedule D

- FOMB – PREPA – First Amended PDA – Schedule E

- FOMB – Media Release – PREPA Plan of Adjustment – National

- FOMB – Statement by Justin Peterson – PREPA POA

- FOMB – PREPA – Plan of Adjustment

- FROM – PREPA – Disclosure Statement

- FOMB – Media Release – PREPA mediation

- FOMB – PREPA – Mediation documents

- FOMB – Statement by Justin Peterson about PREPA

For copies of the documents filed in the Title III cases, please visit https://cases.ra.kroll.com/puertorico. Copies of the documents are also available by calling +1 (844) 822-9231