Municipal Funding

Puerto Rico’s municipalities are important providers of critical services to all citizens. Municipalities provide services including support for: public works, social affairs, education, recreation and culture, health, environmental protection, economic development and public order and safety. To ensure that municipalities can continue to provide these services to residents, it is crucial that they work towards achieving fiscal sustainability and promoting economic development.

The certified Fiscal Plan for Puerto Rico and the certified Fiscal Plan for the Municipal Revenues Collection Center (CRIM) detail the current funding sources available to municipalities and establish a roadmap for achieving fiscal responsibility through more efficient spending, economic development, and maximization of federal funds. The Oversight Board continues to provide support to help municipalities achieve these goals.

The municipal equalization fund

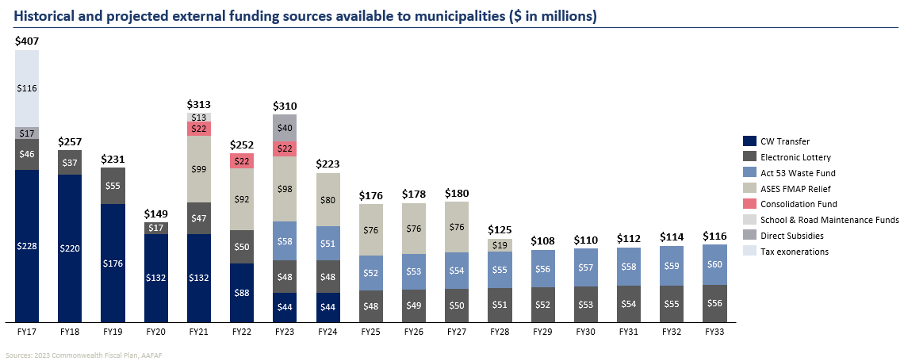

Like the Central Government, in recent years, Puerto Rico’s 78 municipalities have confronted significant fiscal and economic challenges. To respond to this fiscal reality and to incentivize a new operating model between the central and municipal governments, starting in 2015, the Commonwealth government proposed the reduction of certain Commonwealth financial transfers to the municipalities. The Oversight Board subsequently adopted the Central Government’s proposal to reduce these financial transfers in the certified fiscal plans. In FY2024, the Commonwealth transfer will total $44 million, representing an 80% reduction from the baseline $220 million transfer in FY2018. A full phase-out is planned by FY2025.

Commonwealth transfers are a component of the Equalization Fund, which also includes certain electronic lottery proceeds and the Act 53 Waste Fund. Historically, Puerto Rico’s municipalities have relied heavily on these financial subsidies from the central government.

Funding Puerto Rico’s Municipalities

In recognition of the important value provided by municipalities, over the past 3 years, the Oversight Board authorized and funded the establishment of multiple new appropriations and investments to offset the decline in intergovernmental transfers. This incremental funding includes, among other funds the:

- Act 53 Waste Fund – The Government enacted an “Extraordinary Fund to Address the Collection and Disposal of Residuals, Wastes, and to Implement Recycling Programs in the Municipalities” (Act 53 Waste Fund). This was first provided in the 2021 Fiscal Plan and helps to pay the sanitation and waste collection costs at the municipalities, partially offsetting one of the largest recurring expenses municipalities must pay.

- Federal Funds Medicaid offset – Currently, CRIM is responsible for remitting payments on behalf of the municipalities to fund the Puerto Rico Health Insurance Administration (ASES). The Commonwealth Fiscal Plan includes temporary relief for municipal ASES contributions to reflect the additional funds made available by the federal government using a Federal Municipal Adjustment Percentage (FMAP) calculation. This amount averages approximately $66 million per year for at least the next 5 fiscal years, for a total of $328 million. The Municipalities must, however, continue to pay the remaining share of payments due to ASES in accordance with Act 72-1993.

- Municipal Consolidation Fund – To further incentivize service consolidation, starting with the 2020 Fiscal Plan, incremental funds had been set aside to assist the municipalities in achieving fiscal sustainability. Consolidating services was intended to facilitate municipalities significantly reducing costs and generating additional revenues through economic development and other potential initiatives. This fund totaled $66 million through FY2023 and has been unutilized to date. As initially structured, these funds were to be accessible to municipalities upon the achievement of certain milestones designed to promote the consolidation and optimized administration of the municipalities.

Additional funding sources provided to municipalities are detailed in Volume 3, Chapter 11 of the Commonwealth Fiscal Plan.

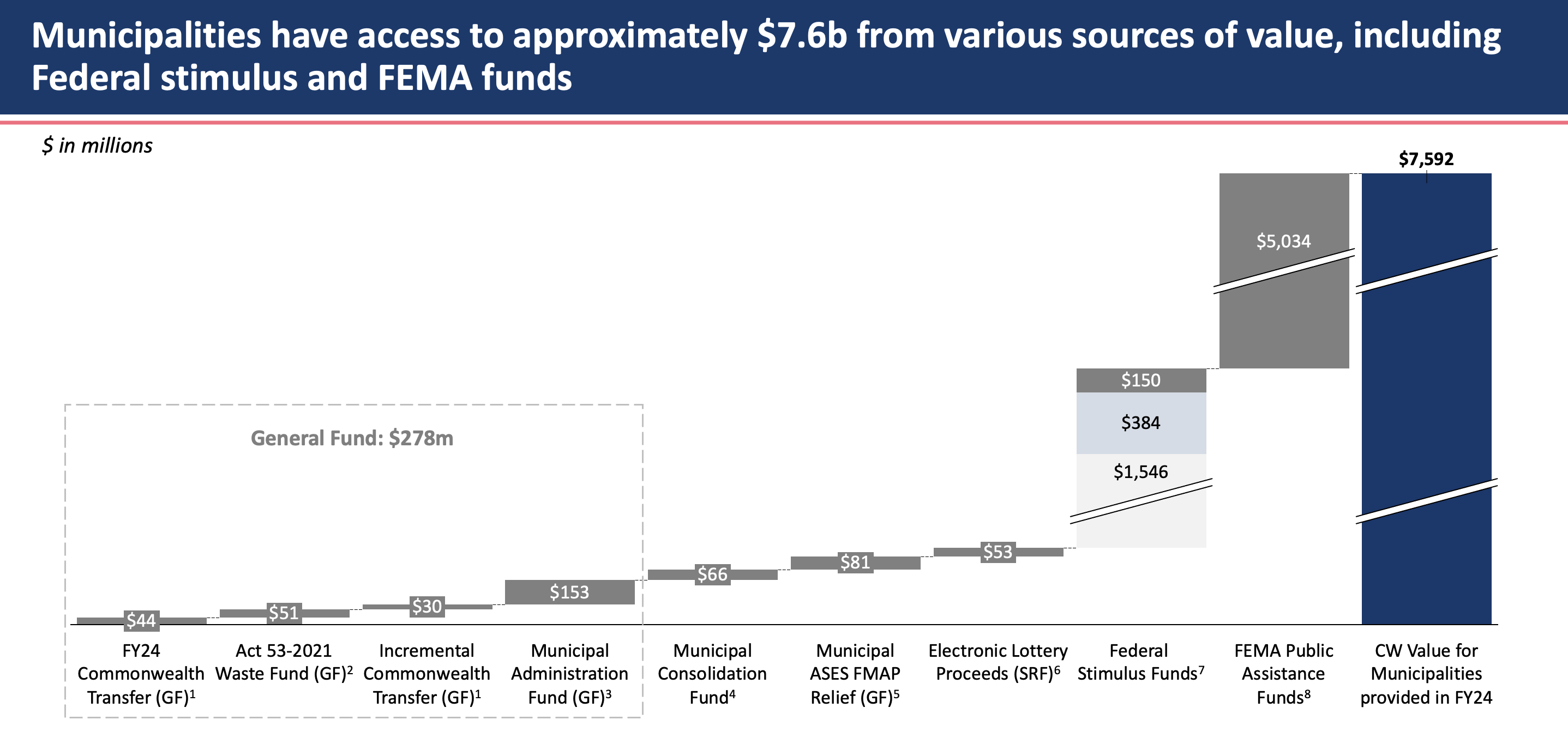

Beyond those sources of alternate funding, municipalities are also in possession of significant federal funds to supplement their budgets in the near term. Taken together, the funding available to municipalities in the near-term is substantial. This funding includes:

- State Fiscal Recovery Funds – The Federal government awarded Puerto Rico $2.47 billion in State Fiscal Recovery Funds through the American Rescue Plan Act (ARPA). From that funding, the Governor allocated $152 million to municipalities to facilitate a Municipal Strengthening Program. As of May 2023, $102 million had been disbursed from the $152 million program.

- Direct fiscal assistance – ARPA also transferred significant funding directly to state and local governments across the country. Puerto Rico’s municipalities received $1.5 billion in direct funding via State and Local Fiscal Recovery Funds (SLFRF). Such funding was made available to assist municipalities in their response to the COVID-19 heath emergency and its economic impacts.

- Other COVID-19 emergency aid – As part of the CARES Act, Puerto Rico’s municipalities received an additional $387 million via the Coronavirus Relief Fund (CRF). Such allocations were provided to help fund the unanticipated costs of battling the COVID-19 pandemic.

- FEMA disaster recovery funding – FEMA’s Public Assistance (PA) program provides grants to municipalities to enable them to quickly respond to and recover from major disasters. Under this program and in support of recovering from a variety of recent natural disasters – including Hurricanes María, Irma, and Fiona, along with an earthquake and Covid-19 – municipalities have been allocated $3.8 billion from the PA program, with an additional $1.2 billion under review for approval in the project formulation stage. Combined, this results in over $5 billion in additional funding for municipalities.

Note: Due to rounding, numbers presented may not add up precisely to the totals provided

1.The CW Transfer of $44m in FY24 is directly appropriated to municipalities through the Municipal Equalization Fund with an incremental $30m provided in FY24 to support funding to the most vulnerable municipalities.

2.The Act 53-2021 Extraordinary Waste Fund was established in 2021, a sub-fund of the Equalization Fund to receive an amount equal to 42% of the prior year 1.03% State Redemption Fund tax; proceeds must be used for waste disposal and recycling programs.

3.The Municipal Administration Fund collects 0.5% of the SUT which is distributed into three funds: (1) 0.2% to the Municipal Development Fund; (2) 0.2% to the Municipal Redemption Fund; and (3) 0.1% to the Municipal Improvement Fund (referred to as the FMM).

4.Consists of unutilized appropriations from the Commonwealth authorized in the FY21-FY23 CW budgets. Funds available subject to the approval of a legislation that restructures the current inventory tax model.

5.ASES savings of $98m represents funding relief provided to municipalities from federal changes to the FMAP percentage, which reduces the statutory baseline contribution to ASES required under Act 72-1993.

6.The Equalization Fund includes 35% of the net annual income from the Additional Lottery System (“Electronic Lottery”) estimated at $53m per the FY22 CRIM Fiscal Plan.

7.Federal Funding includes $2.1 billion of stimulus segmented into three tranches of funds: $1,546m in Federal Stimulus Funds from the ARP Act awarded directly to municipalities in Puerto Rico; $384m from CARES Act (see Appendix 2 in the CRIM fiscal plan for a detailed breakdown of both amounts); and $150m from the State Fiscal Recovery Fund. State Fiscal Recovery Fund program details can be found here: https://recovery.pr.gov/documents/ARPA_State_Programs_Awards_and_Disbursements.pdf

8.Represents funds allocated, along with funds in the project formulation stage from the FEMA Public Assistance Program. Includes funding to support recovery from Hurricanes Maria, Irma, and Fiona, along with an earthquake and Covid-19. Values as of June 26, 2023.

FY2024 Incremental funding & municipal initiatives

To date, despite multiple efforts designed to strengthen Puerto Rico’s municipal structure, achieve fiscal discipline, implement critical reforms and boost economic growth, desired progress to achieve improved outcomes has not been achieved. Municipalities must work with the Executive branch to analyze financial needs for each individual municipality and focus on the necessary enhancements in municipal shared services and other municipal and government initiatives, including inventory tax reform, permitting reform, improvement in tax filing processes, and reprofiling of municipal debt, in addition to initiatives proposed from mayors on broader financial reforms.

Starting in FY2024, once established transformational measures and milestones related to these initiatives are achieved, additional funding from the Commonwealth may be made available to municipalities as part of ongoing collaboration to improve fiscal sustainability. The Oversight Board, the Commonwealth, and the municipalities are currently using the FY2024 budget certification process to agree on specific financial and operational milestones, along with the corresponding conditional funding amounts required for disbursement.

Property tax reform

Property tax reform is a critical requirement for Puerto Rico to modernize its economy and enhance municipal revenues by better aligning the tax base to municipal budget needs, thereby promoting fiscal responsibility throughout the island.

CRIM, which collects property taxes on behalf of municipalities, has been working towards a number of initiatives related to property tax reform, including proposals on inventory tax reform, conversion of real property to market valuation, and an assessment of exemptions and exonerations creating inequity in the tax base. Key progress related to these initiatives has included:

- Real Property Assessments – In Puerto Rico, real property valuations for tax assessments are based on the property’s replacement cost value as if it were constructed in 1957, which was the last time a valuation assessment was performed on real property on the island. This valuation methodology is measured in “Unitarios.” In FY2023, CRIM commissioned a study to consider updating the valuation methodology for real property.

- Exemptions and Exonerations – Puerto Rico offers considerably more tax breaks than other U.S. jurisdictions. In FY2022, nearly 60% of real property, as measured by value, was either exempted or exonerated from taxes, substantially reducing municipalities’ tax bases. CRIM previously conducted a comprehensive review of current property tax exemptions and exonerations and will be preparing a formalized report of observations and conclusions by the end of FY2023.

- Inventory Tax Reform – Over the past several years there has been significant pressure from the Governor, the Legislature, and commercial stakeholders to repeal the Inventory Tax. Throughout FY2023, there were active discussions with these stakeholders regarding potential reforms. These discussions are anticipated to continue throughout FY24.

The Fiscal Plan for Puerto Rico has for many years included the eventual phase out of central government subsidies to municipalities as an important step towards achieving fiscal responsibility and stability. Such subsidies have declined over several years to give municipalities ample time to prepare and work with neighboring municipalities to achieve efficiencies and cost savings through sharing services. The Oversight Board will continue its dialogue with the municipalities on key challenges they face and work to fulfill its mandate under PROMESA to help all of Puerto Rico achieve fiscal responsibility.

Property tax collection

CRIM has several ongoing initiatives to improve the accuracy of the tax registry and property records. This includes updating the tax rolls to include missing properties, accurately reflecting taxable values, and updating ownership status of properties. These measures will allow municipalities to better capture unrealized property tax revenues by increasing tax compliance and improving overall collection rates. Key progress related to these initiatives has included:

- Updating the Property Tax Registry – CRIM completed a Planimetric Project in 2016 to digitally map all properties in Puerto Rico in order to update the Digital Cadaster registry. Updated property information was extracted to identify new construction and home improvements, including identification of newly added structures on vacant land, added swimming pools, and property expansions. Once fully implemented by FY2026, CRIM estimates approximately $291 million of incremental annual tax collections for the municipalities.

- Improving Tax Compliance – As part of enhancing tax compliance and preventing additional tax balances from becoming past due, CRIM has established a new Default Management Office to continue the self-collection of past-due property taxes. This will ultimately improve tax collection rates and increase tax revenues for the municipalities.