This blog was updated in May 2025

Every week, the Puerto Rico Treasury Department reports to the people of Puerto Rico how much money the government collected in taxes and fees, and how much it spent to provide government services, to pay pensions and help those in need of financial support, to pay government employees and vendors, and for other expenses. After expenses are deducted from its collections, the Treasury Department reports how much cash is left in its Treasury Single Account, known as TSA.

The TSA is the central government’s main bank account. The TSA provides transparency in the government’s finances, improves cash management and promotes fiscal discipline.

The TSA is like our checking accounts, which we use to track our incomes and expenses. And, just like everybody’s bank accounts, sometimes the TSA looks like there is more money in the account than we actually have available to spend. That is because some of the money in our checking accounts is already allocated to payments we haven’t made yet, but we know are coming, or payments that we made but that aren’t yet reflected as having come out of the account. These kinds of payments could include mortgages, car payments, credit card payments and utility bills.

When we receive a paycheck on the first of the month, our checking accounts look fabulous. But just a few days later, the mortgage gets paid. And we know the car may need an oil change next week, and the credit card bill comes due on, say, the 20th of the month. This is the same for the government: most of the money in the TSA is, in a sense, already spent, appropriated, or obligated for specific areas.

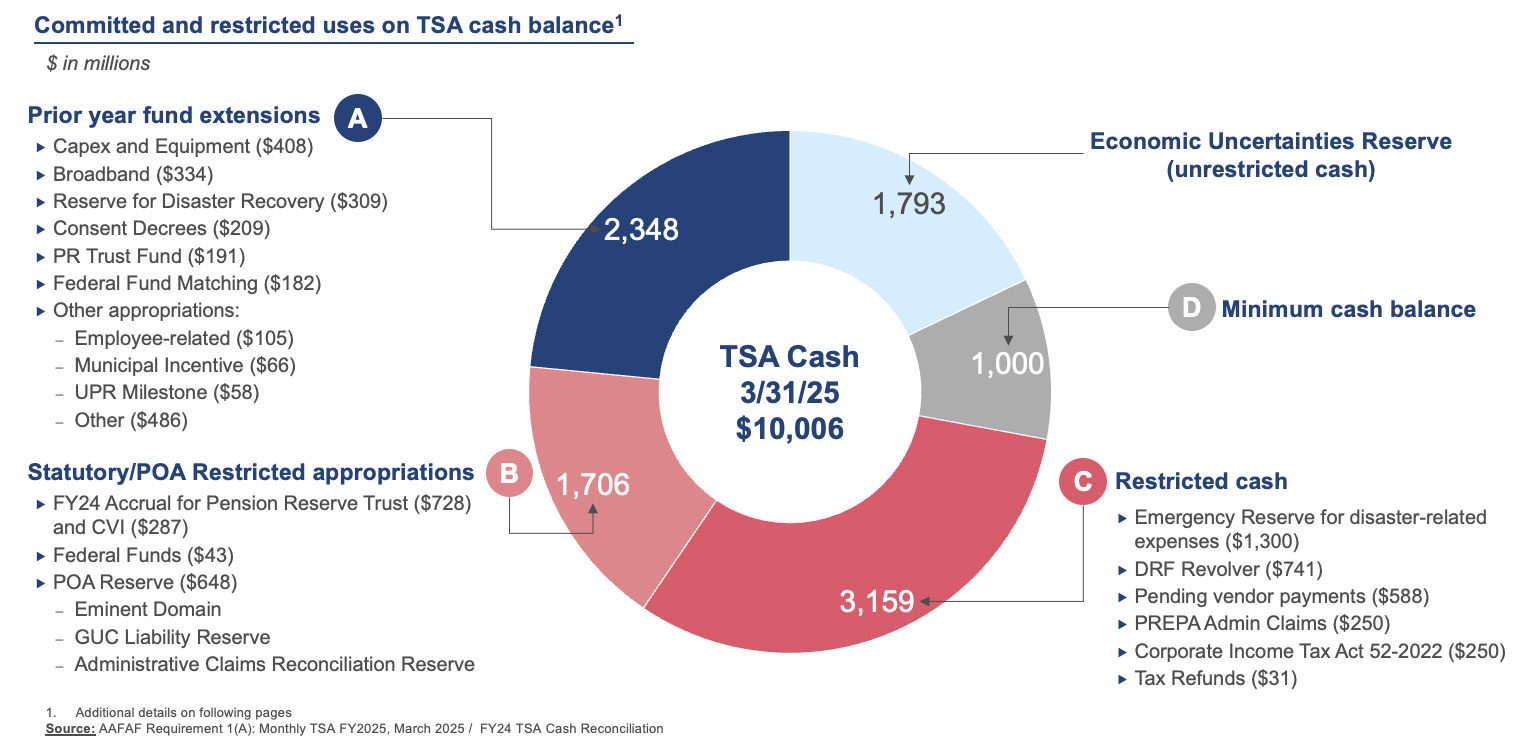

For example, as of March 31, 2025, the most recent data available, the TSA’s total balance was $10.0 billion. It sounds like a lot. But if we peel off all the money that is already allocated to specific government payment obligations, we end up with $1.8 billion, and that includes the Government’s $1 billion minimum operating balance.

Here is why.

Of the total TSA as of March 31, 2025, the Government already committed $2.348 billion as payments for expenses from prior fiscal years. That money has not been spent just yet but will be in the future. These are called “committed” funds. For example, $408 million was set aside for equipment and construction and infrastructure projects, and $344 million was set aside to build a strong broadband network so rural areas are connected to the internet. This is similar to you knowing that a broken air conditioner needs to be fixed or replaced, and that your child needs a new computer when school starts. You know these expenses are coming and you responsibly put the money aside. You can’t spend the money for these expenses on something else, but it makes your bank account look much bigger today.

“You can’t spend the money twice,” is how Robert F. Mujica Jr., the Executive Director of the Oversight Board, put it.

The TSA also includes money that is categorized as “restricted.” That means it can only be used for a very specific purpose. One of the biggest portions of these restricted funds, $1.3 billion, is for the Emergency Reserve Fund. These are savings set aside to ensure that the Government has money to help the people of Puerto Rico, fast and effectively, in case of natural disasters and other emergencies. This is an important element of good and responsible housekeeping. When Hurricane Maria hit, Puerto Rico did not have such savings to help residents quickly. The Emergency Reserve has been used several times already, including during the COVID-19 pandemic and for recovery after Hurricane Fiona, so that Puerto Rico is always prepared for an emergency.

Similarly, $1.793 billion has been set aside for an Economic Uncertainties Reserve. This is unrestricted cash that would be used to manage unforeseen events that impact the Puerto Rican economy

In total, $3.159 billion of the TSA money is already allocated based on such specifically intended purposes. Another $1.706 billion is restricted for cash payments related to the central government debt restructuring the court confirmed in 2022. Those are payments mainly to Puerto Rican’s the Government owed money to when it filed for the bankruptcy-like process under PROMESA. For example, employees who made an administrative claim for backpay, or property owners who had claimed that they didn’t get properly reimbursed by the government under eminent domain get paid from this money set aside. The court ordered that money to be paid, and the Government will pay it out.

If those $7.213 billion in committed and restricted funds are not spent as previously allocated, the Government would get into financial and legal trouble.

The $1 billion minimum operating cash, meanwhile, is like the minimum balance left in a family’s bank account after mortgages, car payments, utilities, groceries and other living expenses have been paid for. This cash balance is necessary so the government can continue to pay employees and pensions if it doesn’t get all its income in time, for example when tax payments are late due to a technical glitch or a natural disaster.

Being fiscally responsible, both for the government and individuals, involves careful planning, budgeting, and spending. This is the way to secure long-term financial stability. The TSA is an important tool for governments to ensure revenues are collected and expenses are properly paid. According to financial experts, a true TSA as a centralized cash management system is the correct way to manage the Government’s financial resources. This is how governments around the world operate. Also, it is just as important to understand what the TSA is and what it is not, and what cash is available and what is already committed.